The Financial Fix: Tax and Financial Planning for Success

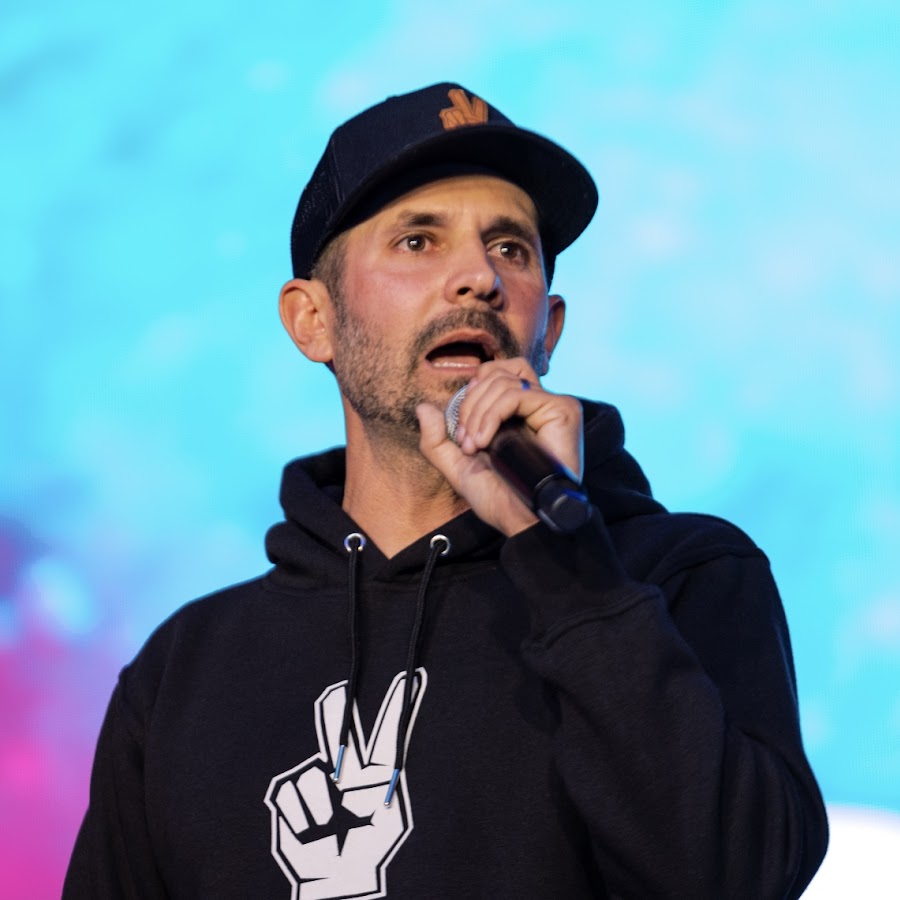

with Alex Sonkin

Video:

Audio:

Welcome back to Making Bank. On today’s episode, we have Alex Sonkin who is the founder of the Due Diligence Project and the virtual family office hub. It’s a revolutionary platform of vetted resources that supports hundreds of leading tax focused CPA firms and the family offices around the country.

This episode talks about exactly what that is and how that’s going to benefit you being an entrepreneur and owning your own company.

Make sure to listen to this Episode of Making Bank with Alex Sonkin.

(3:56) Background

Alex Sonkin came from the Soviet Union at the age of seven with his parents and graduated from University of Michigan. He started as an options trader in Chicago. He then took what he learned from that and went on to work with CPA firms and building family offices. From there on he worked with many other clients, started what was called the Due Diligence’s Project and has been helping different clients ever since.

(8:48) Family Offices

Real benefit of a family office is it’s truly one point of contact for the affluent business owner and traditionally, family offices were for very wealthy families. What you’re doing is you’re building an office. You have your CPA firm, your law firm, you have advisory all in one spot and when you have a problem you just need to contact one source and you are done.

(13:03) Income Taxes

The one specialty that seems most complicated of everything in the world of finance seems to be income tax. Because we’re dealing with a document, no one knows how many pages there are. It takes special licenses to understand it and it takes a certain number of hours. It takes at least 10,000 hours of experience in audit and tax court to really understand the risk and to really understand income taxes.

(15:46) Tax Strategies

The key to this is not the strategies themselves. The key to this is having your CPA, your most trusted tax advisor, plug into the network, the Due Diligence Project where they get exposed to the community and certain strategies are going to work well for certain people and certain types of fact patterns.

(18:43) Who’s It For?

The target is the tax advisor. It’s the CPA. After the business owners are introduced, meeting their CPA is advised and encouraged so they can get plugged into the network and really work accordingly to help the business and be really diligent at their work.

(20:51) Zero Taxes

It is done by taking reviews every year. Focus on what can be improved based on feedback or questions from many of the CPA firms that are within the program. If there is a problem with the strategy it will be fixed and cleaned up, or the strategy might get revisited altogether.

(24:02) Common Mistakes

Very common mistake is that most business owners have a difficult time differentiating. Many business owners aren’t aware of that fact and so they’re asking the wrong people the wrong questions, failing to remember that the financial world is very complex and there are specialists for every aspect.

Link:

Alex Sonkin

@grouplombardi

www.linkedin.com/in/alexsonkin

www.duediligenceproduct.com

www.vfohub.com

Topics

- Accelerated Learning

- Artificial Intelligence

- Become Present

- Blockchain

- Branding

- Business

- Education

- Entrepreneurship

- Family

- Finance

- Health

- Health & Wellness

- Internet Marketing

- Investing

- Leadership

- Lifecoach

- Marketing

- Negotiation

- Performance

- Productivity

- Publicity

- Real Estate

- Sales

- Sales Success Habits

- Video Marketing

- Writing